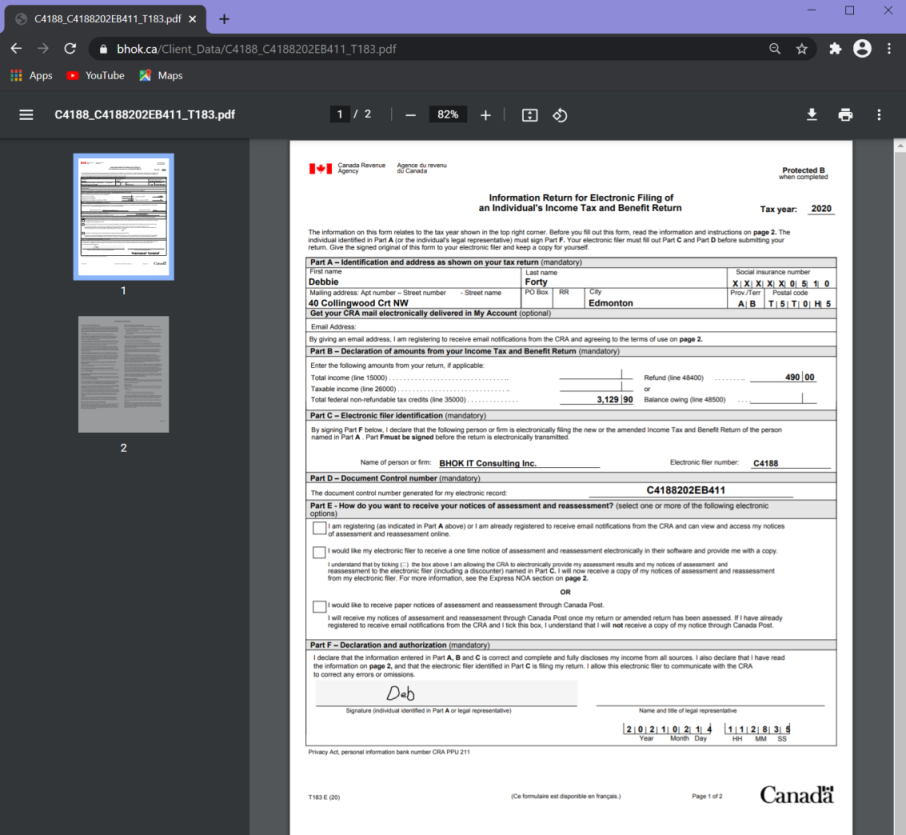

This page presents the steps required to remotely sign forms generated by tax preparers for their clients. The tax preparer creates an electronic signature request and email a web link to the client. The client uses the link to navigate to an Electronic web application that enable the electronic signing of forms. You will also need a PIN that you can get from your tax preparer. Once you have both to link and PIN, you will be able to start the process of signing the form.

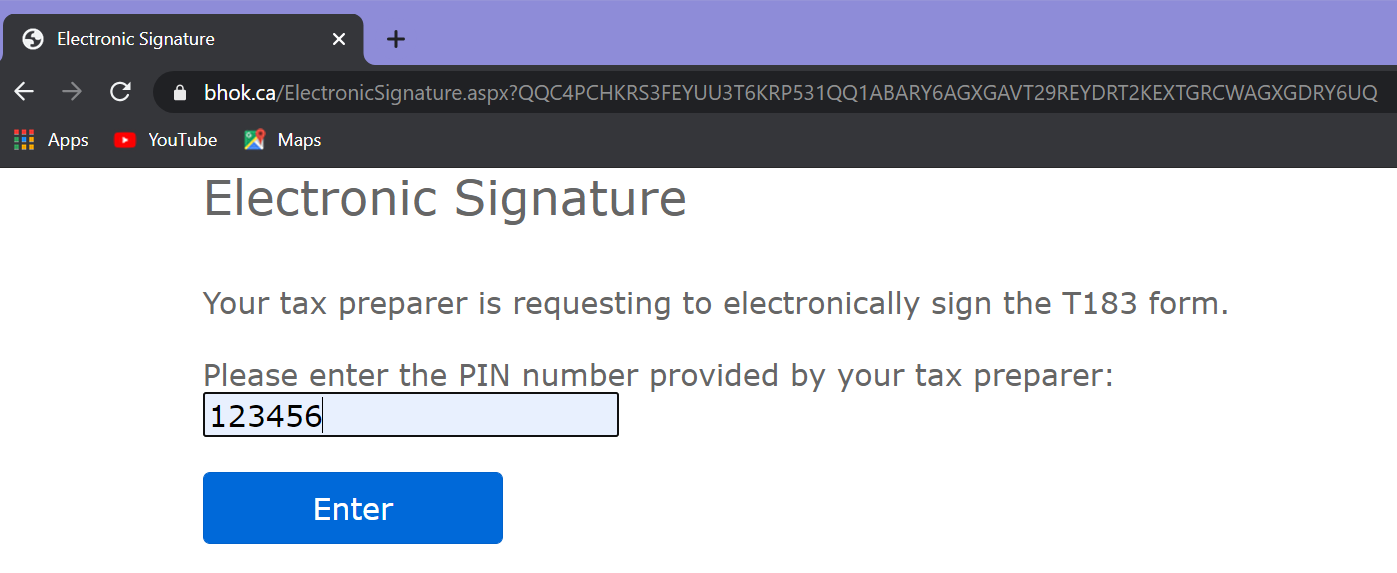

Start

- Click the link received by email from your tax preparer

- Enter the PIN number and press Enter

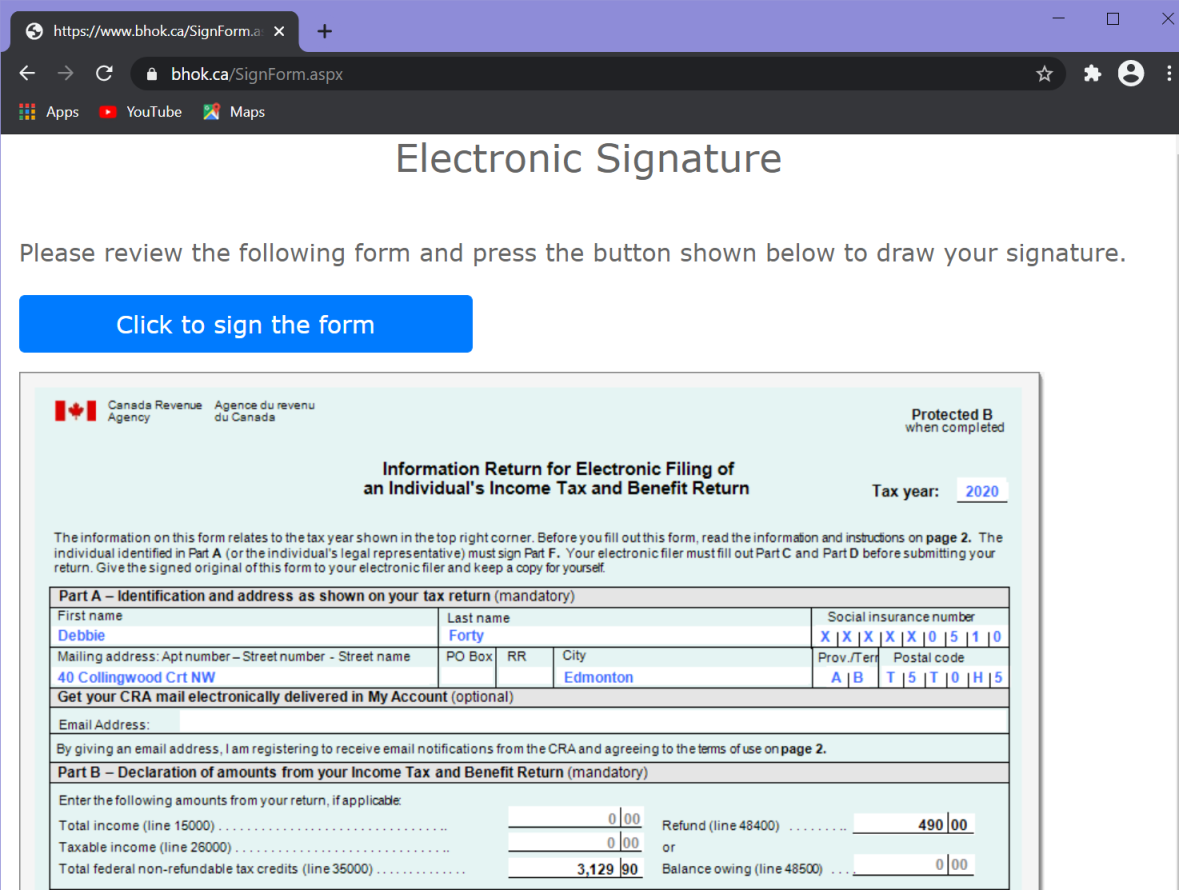

Review the form

Review the content of the form and press the sign button to access the signing page.

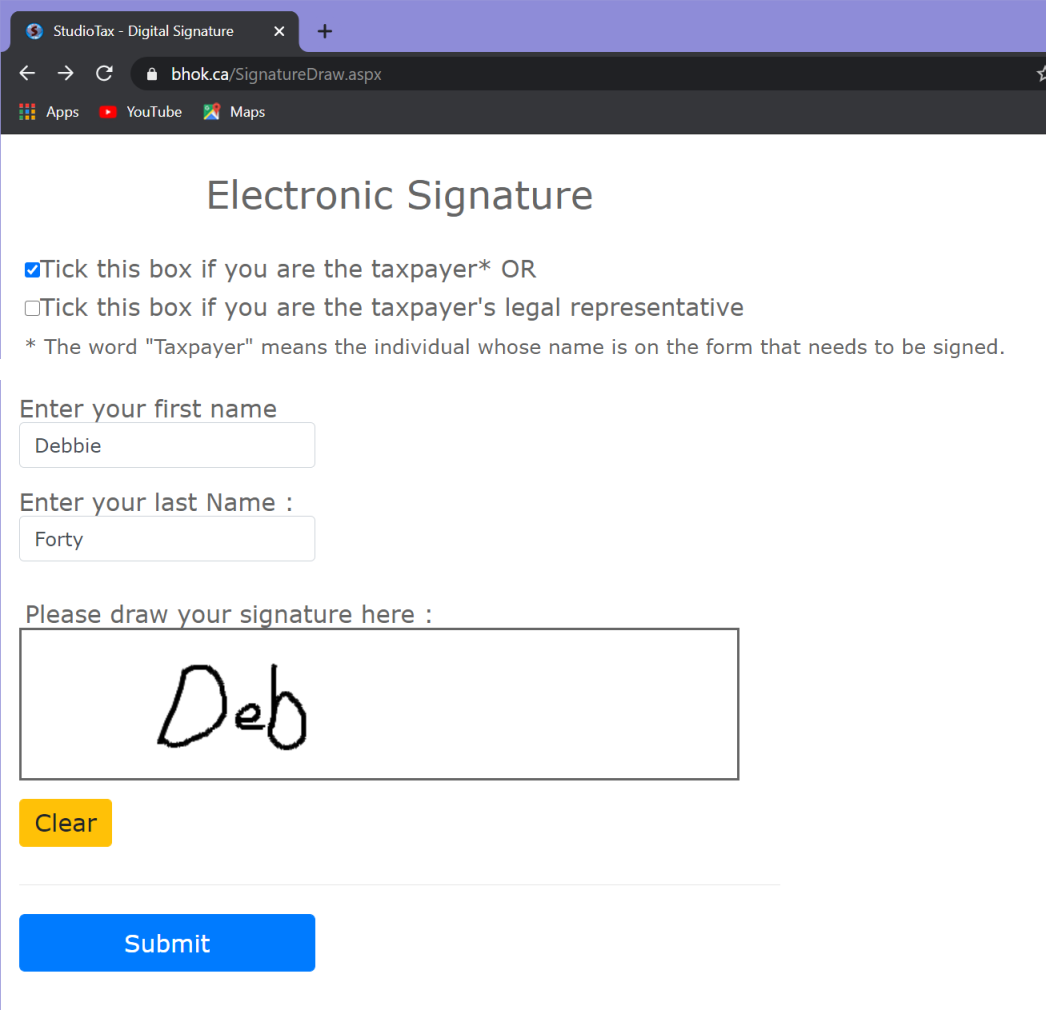

Sign the form

You need to perform the following tasks at the signing page :

- Tick one of 2 boxes to specify if you are the taxpayer or his/her legal representative.

- Enter your first and last name.

- Draw your signature using the mouse or a stylus. If you have access to a touchscreen, you can use your finger to create an electronic signature. You can use the Clear button to erase the signature and start over.

- Once you are satisfied with the signature graphics, press the submit button to save the signature.

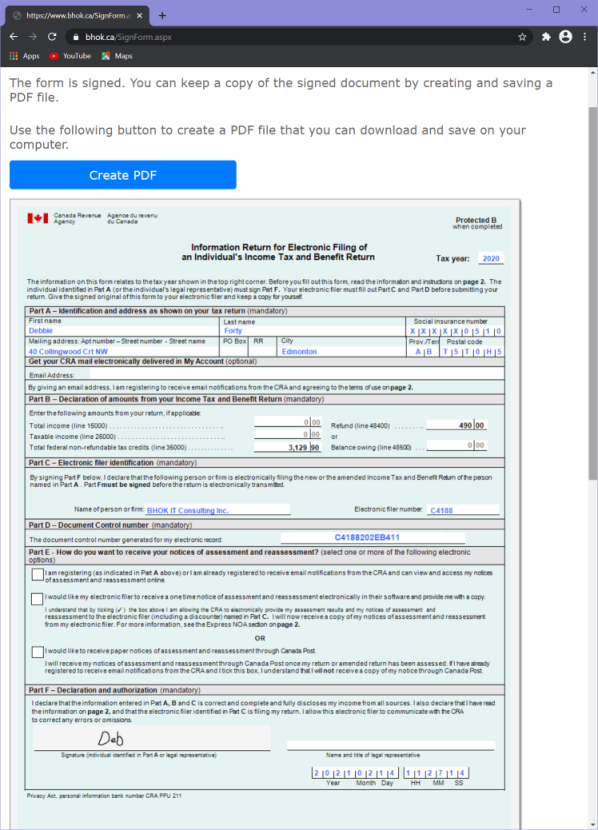

Review the signed form

Review the signed form and use the Create PDF button to save a copy for your records.

Save a copy for your records

You can print and/or download the PDF file to your computer. Make sure to inform your tax pareparer that you signed the form.